Issue #6: The Tiger Woods-Nike Break Up

What the end of the sports partnership means for brand deals.

Hi! It’s a short one today, since it’s such a busy week over here. I initially started writing about the Lululemon/Chip Wilson saga happening right now, but as I started getting into it, I realized that it’s a huge can of worms that, as much as I’d like to, I simply do not have the time to open right now. The whole brand DEI conversation is so interesting to me and deserves a good amount of attention and time, so I’m tabling it for this week with the plan to revisit soon.

I’m also trying a few new things for this issue: making it a bit shorter and more digestible, adding a TLDR section up top, and incorporating polls for you to engage! As always, I’m open to feedback to make Brand Baby even better.

TLDR:

Tiger and Nike have announced that their 27 year-long partnership is coming to an end.

The split represents recent trends in the athlete-sponsorship arena, such as movement towards equity as a form of partnership compensation.

Brand equity is mutually beneficial for both brands and athletes, since athletes are incentivized to promote the brand and its products.

Brand equity deals may encourage influencer marketing, which we know to be a super powerful tactic.

If you watched Air, the movie about Nike’s deal with Michael Jordan that came out last year, then you know just how meaningful that partnership with the promising athlete became in shaping Nike’s brand. Jordan’s partnership with Nike exceeded simple product endorsements or cameos in ad spots – it built an entire empire around a line of Jordan products, while also creating a major, influential brand personality of young Jordan.

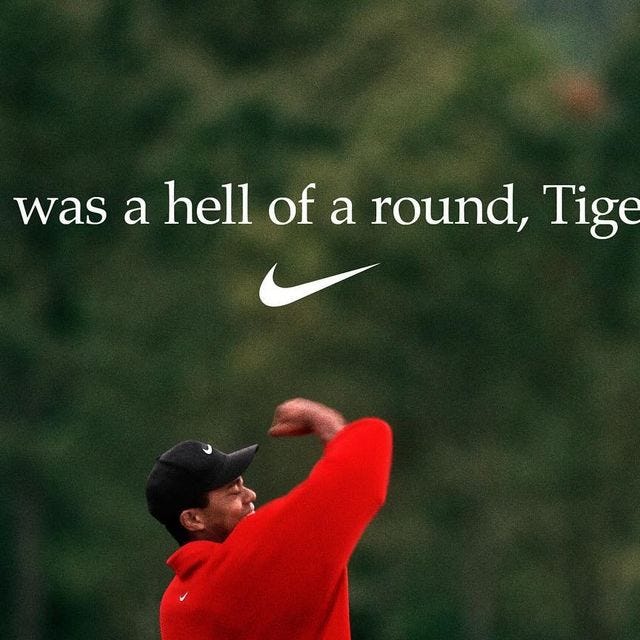

Tiger Woods and Nike have experienced a similar relationship over the past 27 years. Woods solidified his partnership with Nike back in 1996 with a five-year, $40 million deal that led to future contracts over the past few decades. As Woods saw major success while wearing his classic red Nike golf polo every Sunday, the popularity of golf increased in tandem, resulting in the development of Nike’s line of golf equipment and apparel. Tiger became the face of golf and the face of Nike golf – with a variety of legendary commercial advertisement spots to support him.

This past week, Tiger announced that his decades-long partnership with Nike is coming to an end. While he didn’t share exactly why it’s over, there’s some speculation based on larger trends happening in the sports-brand deal world.

For athletes who are seeking more than a fixed payout, equity stakes have become an increasingly popular way for professional athletes to invest in companies. Roger Federer, who also left his relationship with Nike in 2018 to sign with Uniqlo, signed a deal with On Holdings in 2019 for 3% equity in the running shoe company (there are also talks about Woods signing on with On, but nothing’s been confirmed). With other athletes and celebrities doing the same, it’s clear that there’s desire for greater financial stake in brands. Granting equity is mutually beneficial for both athletes and the brands that they’re working with, since it incentivizes athletes to promote the brand and contribute to its success because it will result in their own financial gain. Not only do partnered athletes enjoy the product, but they are also invested in the success of the product.

We know how important influencer marketing is these days. While traditional commercial ad spots like Tiger’s used to be the bread-and-butter of athlete partnerships, influencer content creation has largely replaced old school television ads. The personal brands of athletes, celebrities, and influencers have come to outweigh the impact of most corporate brands. And brand equity deals encourage athletes and celebrities to build strong social presences and to monetize their digital content creation, which turns into boosted product sales and larger equity payouts for athletes in return.

Plus, when an athletic career can be completely destroyed by just one injury, obtaining brand equity provides the benefit of greater financial security. The payouts can be long-lasting and significant, while also allowing the athlete to get involved in the company’s day-to-day operations (depending on the amount of equity that they take on, of course), which can set them up for a future in business and entrepreneurship once their professional athletic career concludes. While the end of the Woods-Nike partnership marks the end of an era, l’m looking forward to seeing what Tiger gets up to next and if it comes to represent a new future for athlete brand deals.

See you next week!

Loved the post...and the poll!